TPCO Holding Corp.

1550 Leigh Avenue

San Jose, CA 95125

June 14, 2024: The Notice of Annual GeneralMeeting, this Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2023, and Special Meeting of Shareholders

The 2022the proxy card, are available at www.proxyvote.com.

TABLE OF CONTENTS

________________________

In this Proxy Statement, the words “Gold Flora Corporation,” the “Company,” “we,” “our,” “us” and similar terms refer to Gold Flora Corporation unless the context indicates otherwise.

3165 Red Hill Avenue

Costa Mesa, CA 92626

April 29, 2024

To Our Stockholders:

You are cordially invited to attend the 2024 annual

general and special meeting of

(the “Meeting”)stockholders of

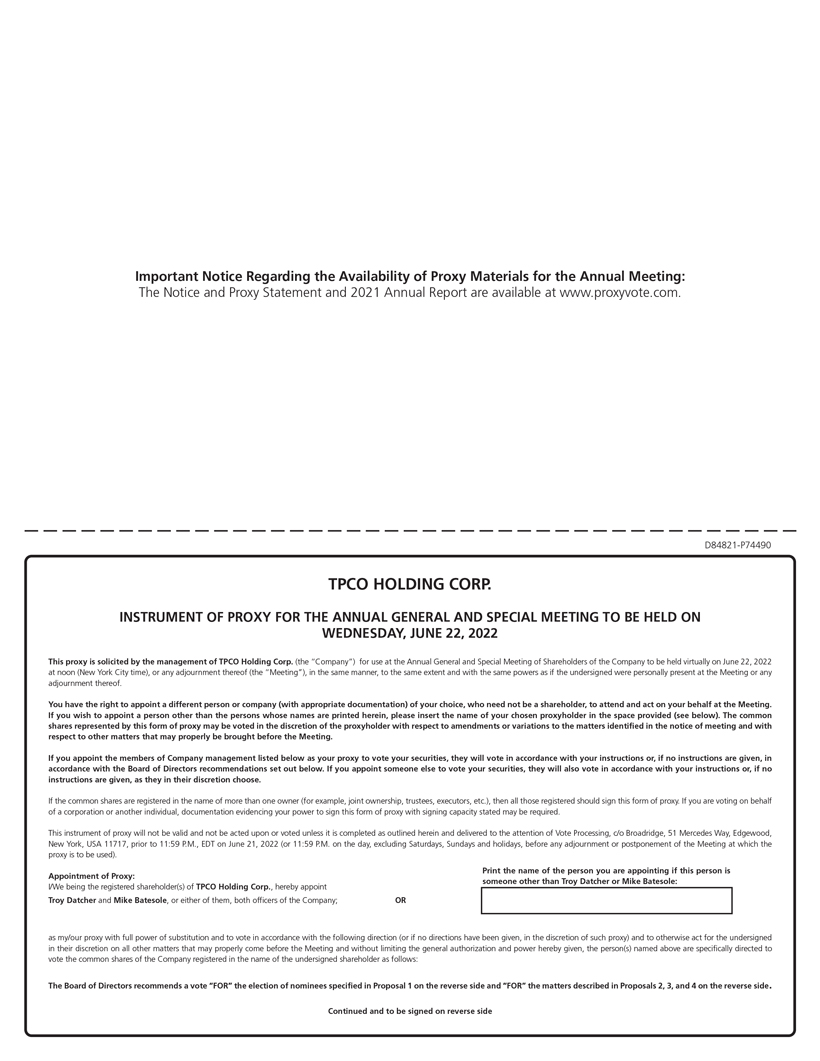

the holders (the “Shareholders”) of common shares (“Shares”) of TPCO Holding Corp., a British Columbia corporation (the “Company”), willGold Flora Corporation to be held

at 9:00 a.m Pacific Time on

Wednesday, June

22, 2022 beginning at noon (New York City time),14, 2024. We have decided to hold this year’s annual meeting virtually via live audio webcast

online at www.virtualshareholdermeeting.com/GRAMF2022.The following matterson the internet. We believe hosting a virtual annual meeting enables greater stockholder attendance and participation from any location around the world, improves meeting efficiency and our ability to communicate effectively with our stockholders, and reduces the cost and environmental impact of our annual meeting. You will be considered atable to attend the Meeting:

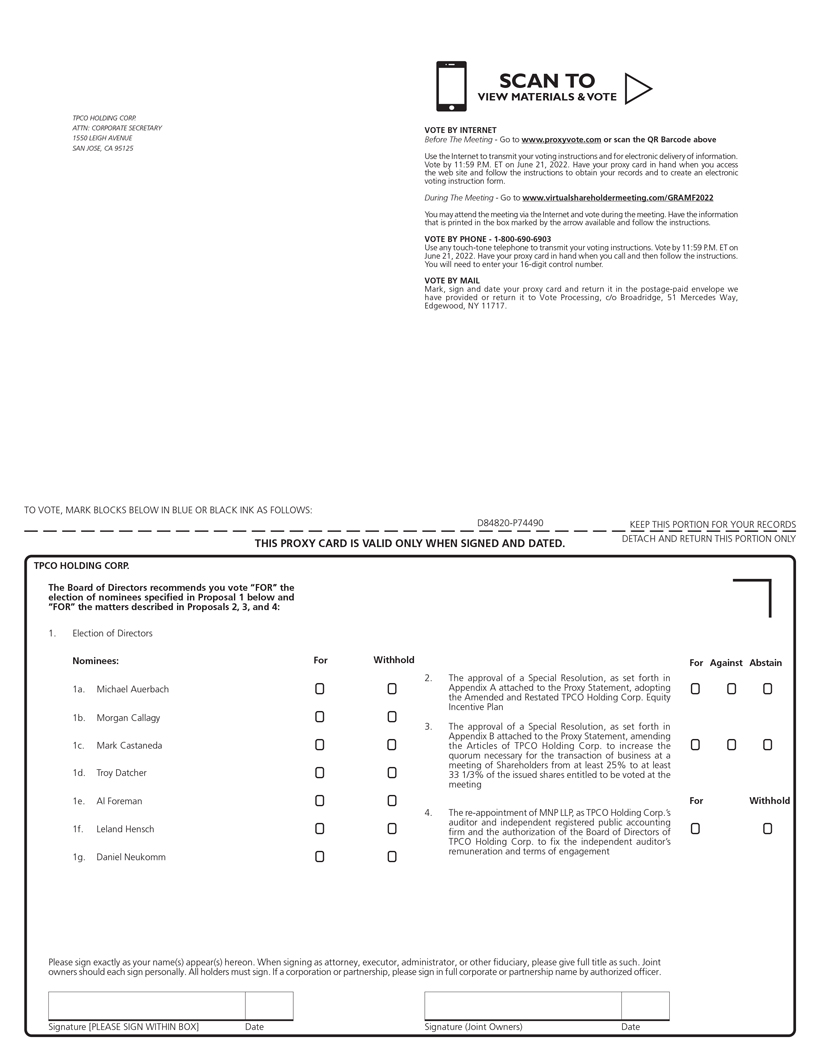

| 1. | The election ofannual meeting, vote and submit your questions during the annual meeting by visiting www.virtualshareholdermeeting.com/GRAM2024. You will not be able to attend the annual meeting in person.

Details regarding the meeting, the seven persons named in the attached proxy statement to the board of directors of the Company (the “Board”) for the ensuing year; |

| 2. | The approval of a Special Resolution, as set forth in Appendix A to the attached proxy statement, adopting the Amended and Restated TPCO Holding Corp. Equity Incentive Plan;

|

| 3. | The approval of a Special Resolution, as set forth in Appendix B to the attached proxy statement, amending the Company’s Articles to increase the quorum necessary for the transaction of business at a meeting of Shareholders from at least 25% to at least 33 1/3% of the issued shares entitled to be voted to at a meeting;

|

| 4. | The re-appointment of MNP LLP (“MNP”) as the Company’s auditor and independent registered public accounting firm and the authorization of the (the “Board”) to fix MNP’s remuneration and terms of engagement; and

|

| 5. | The transaction of such other business as may properly come before the Meeting or any adjournment or postponement thereof.

|

The Board is not aware of any other business to be presentedconducted at the meeting, and information about Gold Flora Corporation that you should consider when you vote your shares are described in the accompanying proxy statement.

At the annual meeting, six people will be elected to aour board of directors (the “Board”). In addition, we will ask stockholders to ratify the appointment of Macias Gini & O’Connell LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. The Board recommends the approval of each of these proposals. Holders of our common stock will be entitled to vote on Proposal 1 (Election of Board Members) and Proposal 2 (ratification of the Shareholdersappointment of the Company's independent registered public accounting), as further described in the accompanying Proxy Statement. Such other business will be transacted as may properly come before the annual meeting.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to certain of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the

Meeting.This noticesame time conserving natural resources and lowering the cost of delivery. On May 3, 2024, we intend to begin sending to our stockholders a Notice of Internet Availability of Proxy Materials (the Internet Availability Notice) containing instructions on how to access our proxy statement for our 2024 Annual Meeting of Stockholders and our 2023 annual report to stockholders. The Internet Availability Notice also provides instructions on how to vote online or by telephone, how to access the virtual annual meeting and how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the annual meeting. Whether you plan to attend the annual meeting or not, it is accompaniedimportant that you cast your vote either in person or by proxy. You may vote over the Internet as well as by telephone or by mail. When you have finished reading the proxy statement, andyou are urged to vote in accordance with the accompanying proxy card or voting instruction form. The Company is using notice-and-access to deliverinstructions set forth in the proxy materialsstatement. We encourage you to Shareholders. This meansvote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of Gold Flora Corporation

Sincerely,

Laurie Holcomb

Chief Executive Officer

3165 Red Hill Avenue

Costa Mesa, CA 92626

(669) 279-5390

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the proxy materials are being posted online2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Gold Flora Corporation (Company) to access, rather than being mailed out. Notice-and-access substantially reducesbe held virtually via live audio webcast at www.virtualshareholdermeeting.com/GRAM2024 on Friday, June 14, 2024 at 9:00 a.m., Pacific Time, for the Company’s printingfollowing purposes:

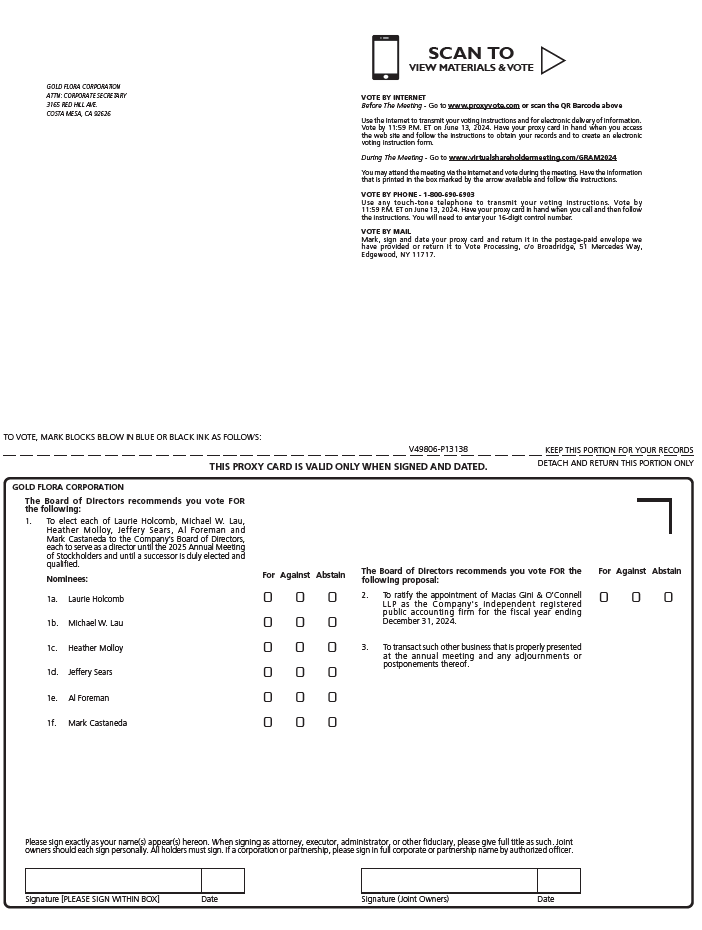

1.To elect each of Laurie Holcomb, Michael W. Lau, Heather Molloy, Jeffery Sears, Al Foreman and mailing costsMark Castaneda to the Company's Board of Directors, each to serve as a director until the 2025 Annual Meeting of Stockholders and until a successor is environmentally friendlyduly elected and qualified.

2.To ratify the appointment of Macias Gini & O’Connell LLP as it reduces paperthe Company's independent registered public accounting firm for the fiscal year ending December 31, 2024.

3.To transact such other business that is properly presented at the annual meeting and energy consumption.The Meetingany adjournments or postponements thereof.

A list of registered stockholders of record as of the Record Date (defined below) will be accessibleavailable at www.virtualshareholdermeeting.com/GRAMF2022. We have determinedthe annual meeting and during the 10 days prior to hold the Meeting in a virtual-only format. To participate inannual meeting, at our principal executive offices located at 3165 Red Hill Avenue Costa Mesa, CA 92626.

The Company's Board of Directors has fixed the

Meeting, you must be a Shareholderclose of business on

April 23, 2024 as the record date

for determining the stockholders entitled to receive notice of,

April 29, 2022. Youand to vote at, the Annual Meeting or any adjournments or postponements thereof (Record Date). The Annual Meeting may

vote your shares and will have the opportunitybe adjourned or postponed from time to

submit questions duringtime without notice other than by announcement at the meeting.

Please note that

All stockholders of the Company are cordially invited to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, we urge you to vote by following the instructions in order to access the meeting, Shareholders will need their unique control number that appears on the Notice of Internet Availability of Proxy Materials that you previously received and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum.

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting virtually. You may vote on the Internet, by telephone, or by completing and mailing a proxy card

(printed in the box and marked by the arrow) or

the instructions that accompanied the proxy materials, as applicable. Instructions should be provided to beneficial owners on the voting instruction

form provided by their broker or bank or other nominee. If you do not haveform. Submitting your

control number, you will not be able to join the Meeting.We want to ensure that all Shareholders are afforded the same rights and opportunities to participate, including access to the Board and our management, as they would at an in-person meeting.

If you encounter any technical difficulties when accessing or using the Meeting website, please call the technical support number that will be posted on the Meeting website login page. The Meeting website is supported on browsers and devices running the most updated version of applicable software and plugins.

Please note that, due to the virtual nature of the Meeting, you will not be able to provide a proxy to the Chair of the Meeting at the Meeting.

Most Shareholders have a choice of voting over the Internet, by telephone, or by using a traditional form of proxy. Please refer to the attached proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. Your vote by proxymail will ensure your representationshares are represented at the Meeting, regardless of whetherAnnual Meeting. You may change or revoke your proxy at any time before it is voted at the Annual Meeting. Please read the enclosed information carefully before voting.

Your vote is important. Even if you

attend the Meeting or not.Whether or not you expectplan to attend the Annual Meeting, pleasewe urge you to submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the "Questions and Answers About Proxy Materials, Voting and Attending the Annual Meeting" section of this Proxy Statement and your enclosed proxy or voting instruction form with your voting instructions.

card. |

DATED as of May 2, 2022 |

By Order of the Board of Directors |

|

|

|

Troy Datcher |

Chief Executive Officer |

By Order of the Board of Directors,

Judith Schvimmer

Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY STATEMENT MATERIALS

FOR THE 2022 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS STOCKHOLDERS

TO BE HELD ON

JUNE 22, 2022June 14, 2024

The Notice of Annual Meeting, the proxy statement, our form of proxy card and our 2023 annual report to stockholders are available for viewing at www.proxyvote.com. To view these materials please have your 16-digit control numbers available that appears on your Internet Availability Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements for the fiscal year ended December 31, 2023, on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov, on SEDAR+ at www.sedarplus.com, or in the “Investors” section of our website at ir.goldflora.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge, from us by sending a written request to: 3165 Red Hill Avenue Costa Mesa, CA 92626, Attention: Corporate Secretary. Exhibits will be provided upon written request and payment of an appropriate processing fee.

PROXY STATEMENT FOR GOLD FLORA CORPORATION

2024 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON June 14, 2024

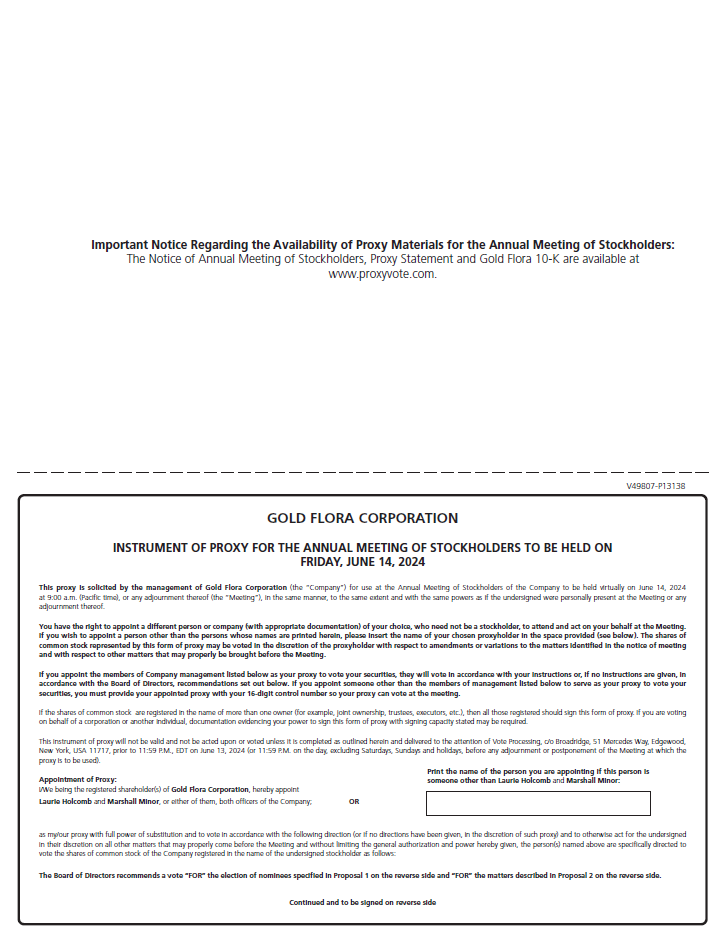

This proxy statement, along with the accompanying notice of 2024 annual meeting of stockholders, contains information about the 20222024 annual general and special meeting of (the “Meeting”)stockholders of Gold Flora Corporation, including any adjournments or postponements of the holders (the “Shareholders”) of common shares (“Shares”) ofannual meeting. We are holding the annual meeting at 9:00 a.m., Pacific Time, on June, 14, 2024, virtually at www.virtualshareholdermeeting.com/GRAM2024.

On July 7, 2023, the Company consummated a business combination transaction involving TPCO Holding Corp. to be held on Wednesday, June 22, 2022 beginning at noon (New York City time)(“TPCO”), via live audio webcast online at www.virtualshareholdermeeting.com/GRAMF2022.The boardGold Flora, LLC, Stately Capital Corporation ("Stately"), a newly formed British Columbia corporation ("Newco") and Golden Grizzly Bear LLC ("US Merger Sub") resulting in the combination of directorsTPCO and Gold Flora, LLC, in an all-stock transaction (the “Business Combination”). As part of the CompanyBusiness Combination: (i) TPCO, Stately and Newco amalgamated to form a new corporation (the “Board”“Resulting Issuer”) is usingand all the shares in the capital of TPCO, Newco and Stately outstanding immediately prior to the amalgamation were cancelled in exchange for common shares in the capital of the Resulting Issuer pursuant to a court-approved plan of arrangement under the

Business Corporations Act (British Columbia); and (ii) the Resulting Issuer acquired all the issued and outstanding membership units of Gold Flora, LLC by way of a merger involving US Merger Sub and Gold Flora, LLC.

In this proxy statement, the terms “Gold Flora,” “the Company,” “we” and “us” refer to solicit proxies for use atGold Flora Corporation, the Meeting. UnlessDelaware Resulting Issuer resulting from the context otherwise requires, referencesBusiness Combination following its continuation out of British Columbia and re-domiciliation to “we,” “us,” “our,” “Company”the State of Delaware pursuant to Section 388 of the Delaware General Corporation Law under the name “Gold Flora Corporation” and (ii) “TPCO” or “TPCO” or similar terms refers“The Parent Company” refer to TPCO Holding Corp. togetherand its subsidiaries prior to completion of the Business Combination. For further information with its wholly-owned subsidiaries. The mailing addressrespect to the Business Combination, please refer to our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”).

As a result of

our principal executive offices is 1550 Leigh Avenue, San Jose, California 95125.Unless otherwise specified, the information contained in this proxy statement is given as of May 2, 2022,Business Combination, Gold Flora Corporation became the date of this proxy statement.

We will send a notice of Internet availability of proxy materials (the “Notice of Internet Availability”)successor issuer to Shareholders on or about May 6, 2022 to shareholders of record date as of April 29, 2022 (the “Record Date”).

TPCO Holding Corp.

We are an “emerging growth company” under applicable U.S. federal securities laws and therefore permitted to conform with certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the U.S. Jumpstart Our Business Startups Act of 2012 (the

“JOBS Act”“JOBS Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended, (2) the last day of the fiscal year in which we have total annual gross revenue of at least

$1.07$1.235 billion, (3) the last day of the fiscal year in which we are deemed to be a “large accelerated filer,” as defined in Rule

12b-2 under the Securities Exchange Act of 1934, as amended (the

“Exchange Act”“Exchange Act”), and (4) the date on which we have, during the previous three year period, issued more than $1.0 billion in nonconvertible debt.

This proxy statement relates to the solicitation of proxies by our Board of Directors for use at the annual meeting.

On or about May 3, 2024, we intend to begin sending to our stockholders the Important Notice Regarding the Availability of Proxy Materials

for the MeetingThiscontaining instructions on how to access our proxy statement for our 2024 annual meeting of stockholders and our Annual Report for2023 annual report to stockholders.

2024 PROXY STATEMENT SUMMARY

Set forth below are highlights of important information you will find in this Proxy Statement. This summary does not contain all of the fiscal year ended December 31, 2021, includinginformation that you should consider, and you should read the entire Proxy Statement carefully before voting.

ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | | | | | | | | | | |

| Time and Date | | Record Date | | Place | | Number of Shares of Common Stock Eligible to Vote as of the Record Date |

| 9:00 a.m. (Pacific Time) on June 14, 2024 | | April 23, 2024 | | Virtual Audio Webcast | | 287,617,407 |

VOTING MATTERS

| | | | | | | | |

| | Board Recommendation |

| Proposal No. 1: | The election of each of Laurie Holcomb, Michael W. Lau, Heather Molloy, Jeffery Sears, Al Foreman and Mark Castaneda to our Board of Directors, each to serve as a director until the 2025 Annual Meeting of Stockholders and until a successor is duly elected and qualified. | FOR |

| Proposal No. 2: | The ratification of the appointment of Macias Gini & O’Connell LLP as the Company's independent registered public accounting firm for the year ending December 31, 2024. | FOR |

OUR DIRECTOR NOMINEES

You are being asked to vote on the election of Laurie Holcomb, Michael W. Lau, Heather Molloy, Jeffery Sears, Al Foreman and Mark Castaneda, each of whom currently serve on our Form 10-K forBoard of Directors. Detailed information about the fiscal year ended December 31, 2021 (our “2021 Annual Report”)background and areas of expertise of each director and director nominee can be found in the "Executive Officers and Directors - Directors" section of this Proxy Statement.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Committee Membership |

| Name | Age | Director Since | Principal Occupation | | AC | CC | NGC |

| Laurie Holcomb | 53 | January, 2018 | Principal Executive Officer and Director | | | | |

| Michael W. Lau | 68 | January, 2019 | Director | | | | Member |

| Heather Molloy | 49 | July, 2023 | Director | | | Member | Chair |

| Jeffery Sears | 68 | July, 2023 | Director | | Member | | Member |

| Al Foreman | 51 | January, 2021 | Director | | Member | Chair | |

| Mark Castaneda | 59 | June, 2022 | Director | | Chair | Member | |

AC = Audit Committee; CC = Compensation Committee; NGC = Nomination and Governance Committee

QUESTIONS AND ANSWERS ABOUT

PROXY MATERIALS, VOTING AND ATTENDING THE ANNUAL MEETING

Proxy Materials

Why did I receive a “Notice of Internet Availability of Proxy Materials” but no proxy materials?

We are

available free of charge at www.proxyvote.com.Asdistributing our proxy materials to stockholders via the Internet under the “Notice and Access” approach permitted by the rules of the U.S. Securities and Exchange Commission (“SEC”(the “SEC”). This approach provides a timely and convenient method of accessing the Canadian securities regulators,materials and voting. On or about May 3, 2024, we will begin mailing a “Notice of Internet Availability of Proxy Materials” to stockholders, which will include instructions on how to access our notice of annual meeting of stockholders, this Proxy Statement and our Annual Report and how to vote your shares. The Notice of Internet Availability of Proxy Materials also contains instructions on how to receive a paper copy of the Companyproxy materials and our Annual Report, if you prefer.

What is providing meeting-relatedthe purpose of the proxy materials?

Our Board of Directors is soliciting your proxy to vote at our 2024 Annual Meeting of Stockholders (Annual Meeting), to be held at virtually, on June 14, 2024, at 9:00 a.m., Pacific Time, and any adjournments or postponements of the meeting, which we refer to as the Annual Meeting. You received a Notice of Internet Availability of Proxy Materials because you owned shares of our common stock at the close of business on April 23, 2024 (the “Record Date”), and that entitles you to vote at the Annual Meeting. The proxy materials describe the matters on which our Board of Directors would like you to Shareholders over the Internet (rather than in paper form) in accordance withvote and contain information that we are required to provide to you under the rules of the SEC when we solicit your proxy. As many of our stockholders may be unable to attend the Annual Meeting, proxies are solicited to give each stockholder an opportunity to vote on all matters that will properly come before the Annual Meeting. References in this Proxy Statement to the Annual Meeting include any adjournments or postponements of the Annual Meeting.

What is included in the proxy materials?

The proxy materials include:

1) the Notice of 2024 Annual Meeting of Stockholders and Proxy Statement (Proxy Statement);

2) our Annual Report; and

3) a proxy or voting instruction card that accompanies these materials.

What information is contained in this Proxy Statement and our Annual Report?

The information in this Proxy Statement relates to the “notice-and-access” provisions provided forproposals to be voted on at the Annual Meeting, the voting process, beneficial owners of our common stock, corporate governance matters, the compensation of our directors and certain of our executive officers and other required information. Our Annual Report contains information about our business, our audited financial statements and other important information that we are required to disclose under National Instrument 54-101 – Communication with Beneficial Ownersthe rules of Securities of a Reporting Issuer (“NI 54-101”). This means that, rather than receiving paper copies ofthe SEC.

How can I access the proxy materials

in connection withover the

Meeting in the mail, Shareholders will have access to them online.Internet?

The Notice of Internet Availability will explainof Proxy Materials contains instructions on how to accessto:

1) view the Notice of Meeting, this proxy statement, our 2021 Annual Report and a proxy card or voting instruction form (collectively, the “proxy materials”) for the Annual Meeting on the Internet. Electronic copies ofInternet and vote your shares; and

2)instruct us to send our future proxy materials to you electronically by email.

Our proxy materials are also available at www.proxyvote.com, where you will be asked to enter your control number provided in the Notice of Internet Availability and the proxy materials will be available at www.proxyvote.com. The audited consolidated financial statements of the Company for the years ended December 31, 2021 and 2020 and the related management’s discussion and analysis (“MD&A”), are available on our website at https://ir.theparent.co/financials/quarterly-results/default.aspx. All of the above-noted materials are available under the Company’s profile on SEDAR at www.sedar.com. Shareholders are remindedProxy Materials in order to review these online materials when voting. Electronic copies of the proxy materials in connection with the Meeting will be available at www.proxyvote.com for a period of one year.access such materials.

Shareholders may requestChoosing to receive paper copies of the proxy materials in connection with the Meeting at www.proxyvote.com, or by calling 1-877-907-7643 and entering the provided 16-digit control number, or obtain further information about notice-and-access by calling the toll-free number 1-844-916-0609 (English) or 1-844-973-0593 (French), or, by email at noticeandaccess@broadridge.com. In order for Shareholders to receive the paper copies of the proxy materials in advance of any deadline for the submission of voting instructions and the date of the Meeting, it is recommended to request materials using one of the methods above as soon as possible but not later than June 8, 2022.

The Notice of Internet Availability also explains how you may request that we sendyour future proxy materials to youor "Notice and Access" notification by e-mail or in printed form by mail. If you choose the e-mail option, you will receive an e-mail next year with links to those materials and to the proxy voting website. We encourage you to choose this e-mail option, which will allow us to provide you with the information you need in a more timely manner,email will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and will conserve natural resources.a link to the proxy voting site. Your election to receive proxy materials by e-mail or in printed form by mailemail will remain in effect until you terminaterevoke it.

If you are

Why Are You Holding a Non-registered Shareholder (as defined below), youVirtual Annual Meeting?

This year’s Annual Meeting will

not receive a Notice of Internet Availability directly from us, but your Intermediary (as defined below) will forward you a Notice of Internet Availability with instructions on accessing our proxy materials and directing that organization how to vote your Shares, as well as other options that may be available to you for receiving our proxy materials.

GENERAL INFORMATION ABOUT THE ANNUAL GENERAL AND SPECIAL MEETING AND VOTING

Proxy Materials

Why am I receiving these materials?

Our Board is using this proxy statement to solicit proxies for use at the Meeting to be held viain a virtual meeting format only. We have designed our virtual format to enhance, rather than constrain, stockholder access, participation and communication. For example, the virtual format allows stockholders to communicate with us in advance of, and during, the Annual Meeting so they can ask questions of our Board of Directors or management, as time permits.

How do I access the Virtual Annual Meeting?

The live audio webcast on June 22, 2022of the Annual Meeting will begin promptly at 9:00 a.m. Pacific Time. Online access to the audio webcast will open approximately 15 minutes prior to the start of the Annual Meeting to allow time for you to log-in and test your

device’s audio system. The virtual Annual Meeting is

making these materials available by posting them onlinerunning the most updated version of the applicable software and plugins. You should ensure you have a strong Internet connection wherever you intend to

access, rather than mailing them out unless requested by a Shareholder.As a Shareholder,participate in the Annual Meeting. You should also allow plenty of time to log in and ensure that you are invitedcan hear streaming audio prior to attend the start of the Annual Meeting.

Log-in Instructions. To be admitted to the virtual Annual Meeting,

and are entitled and requestedyou will need to

votelog in at www.virtualshareholdermeeting.com/GRAM2024 using the control number found on the

business items described in this proxy statement. This proxy statement is furnished in connection with the solicitation of proxies by management of the Company. This proxy statement is designed to assist you in voting your Shares and includes information that we are required to provide under the rules of the SEC and applicable Canadian securities laws.These proxy materials are being made available on the Internet or sent to both registered and non-registered Shareholders. In some instances, the Company has distributed copies of the Notice of Internet Availability or the actual notice of Meeting, proxy statement and the accompanying voting instruction form (as applicable, the “Documents”) to clearing agencies, securities dealers, banks and trust companies, or their nominees (collectively “Intermediaries”, and each an “Intermediary”) for onward distribution to Shareholders whose Shares are held by or in the custody of those Intermediaries (“Non-registered Shareholders”). The Intermediaries are required to forward the Documents to Non-registered Shareholders.

Intermediaries are required to seek voting instructions from Non-registered Shareholders in advance of Shareholder meetings. Every Intermediary has its own mailing procedures and provides its own return voting instructions, which should be carefully followed by Non-registered Shareholders to ensure that their Shares are voted at the Meeting. Often, the form of proxy supplied to a Non-registered Shareholder by its Intermediary is identical to the form of proxy provided by the Company to the Intermediaries. However, its purpose is limited to instructing the Intermediary on how to vote on behalf of the Non-registered Shareholder. The majority of Intermediaries now delegate responsibility for obtaining instructions on how to vote from clients to Broadridge Investor Communications Corporation (“Broadridge”). Broadridge typically mails a voting instruction form to the Non-registered Shareholders and asks the Non-registered Shareholders to return the voting instruction form to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Shares to be represented at the Meeting. A Non-registered Shareholder receiving a voting instruction form from Broadridge cannot use that voting instruction form to vote Shares directly at the Meeting. The voting instruction form must be returned to Broadridge or the Intermediary well in advance of the Meeting to have the Shares voted.

Non-registered Shareholders who have elected to receive the Documents by electronic delivery will have received e-mail notification from the Intermediary that the Documents are available electronically at www.proxyvote.com. Please return your voting instructions as specified in the request for voting instructions.

What is included in the proxy materials?

The proxy materials include:

our proxy statement for the Meeting

our 2021 Annual Report; and;

a proxy card or voting instruction form.

What information is contained in this proxy statement?

The information in this proxy statement relatescard previously mailed or made available to the proposalsstockholders entitled to be voted onvote at the Meeting, the voting process, our Board and board committees, corporate governance, the compensationAnnual Meeting.

All of our

directors and executive officers and other required information.I share an address with another Shareholder, and we received only one paper copystockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting. It could become necessary to change the date, time, and/or means of holding the Annual Meeting (including by means of an in person meeting). If such a change is made, we will announce the change in advance, and details on how to participate will be issued by press release, posted on our website, and filed as additional proxy materials. How

Will I be able to ask questions and have these questions answered during the Virtual Annual Meeting?

Stockholders may

I obtain an additional copy?If you share an address with another Shareholder, you may receive only one set of proxy materials unless you have provided contrary instructions.submit questions for the Annual Meeting after logging in. If you wish to receivesubmit a separate setquestion, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/GRAM2024, typing your question into the ‘‘Ask a Question” field, and clicking ‘‘Submit.” Please submit any questions before the start time of the materials, please requestmeeting. Appropriate questions related to the additional copy by contacting our investor relations team at investor@theparent.co or by calling us at (669) 279-5390.

A separate setbusiness of the materialsAnnual Meeting (the proposals being voted on) will be sent promptly following receipt of your request.

answered during the Annual Meeting, subject to time constraints.

What Happens if There Are Technical Difficulties during the Annual Meeting?

Beginning 15 minutes prior to, and during, the Annual Meeting, we will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting, voting at the Annual Meeting or submitting questions at the Annual Meeting. If you

are a registered Shareholder and wish to receive a separate set of proxy materialsencounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the number on the log in

the future, or if you have received multiple sets of proxy materials and would like to receive only one set in the future, please contact Broadridge Financial Solutions at:Broadridge

51 Mercedes Way

Edgewood, NY 11717

screen at www.virtualshareholdermeeting.com/GRAM2024.

Voting Information

1-866-540-7095

If you are a beneficial owner of Shares and you wish to receive a separate set of proxy materials in the future, or if you have received multiple sets of proxy materials and would like to receive only one set in the future, please contact your bank or broker directly.

Note that in light of continued restrictions and orders imposed in connection with the novel coronavirus (“COVID-19”), you should allow more time for receipt and processing of physical mail than under normal circumstances.

Who pays the cost of soliciting proxies for the Meeting?

We will bear the cost of solicitation. This solicitation of proxies is being made to shareholders by mail. Our directors, officers and employees may also solicit proxies in person or by other means. These directors, officers and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses incurred in doing so.

We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners for their reasonable expenses in forwarding solicitation material to those beneficial owners.

What items of business will be voted on at the

Annual Meeting?

The

items of business

itemsscheduled to be voted on at the

Annual Meeting are:

| 1. | | | | |

| Proposal No. 1: | The election of each of Laurie Holcomb, Michael W. Lau, Heather Molloy, Jeffery Sears, Al Foreman and Mark Castaneda to our Board of Directors, each to serve as a director until the seven persons named in this proxy statement to the Board for the ensuing year (the “Director Election Proposal”);2025 Annual Meeting of Stockholders and until a successor is duly elected and qualified. |

| Proposal No. 2: | 2. | The approval of a Special Resolution, as set forth in Appendix A to this proxy statement, adopting the Amended and Restated TPCO Holding Corp. Equity Incentive Plan (the “Equity Incentive Plan Proposal”); |

| 3. | The approval of a Special Resolution, as set forth in Appendix B to the this proxy statement, amending the Company’s Articles to increase the quorum necessary for the transaction of business at a meeting of Shareholders from at least 25% to at least 33 1/3%ratification of the issued shares entitled to be voted to at a meeting (the “Quorum Increase Proposal”);

|

| 4. | The re-appointmentappointment of MNPMacias Gini & O’Connell LLP (“MNP”) as the Company’s auditor andCompany's independent registered public accounting firm for and the authorization of the Board to fix MNP’s remuneration and terms of engagement (the “Auditor Appointment Proposal”); and

|

| 5. | The transaction of such other business as may properly come before the Meeting or any adjournment or postponement thereof.

year ending December 31, 2024. |

See the Proposals section of this Proxy Statement for information on these proposals. We will also consider any other business that is properly brought before the Annual Meeting or any adjournments or postponements thereof. See “What happens if additional matters are my voting choices?

You may select “For” or “Withhold” with respect to each Nominee for director underpresented at the Director Election Proposal and with respect to the Auditor Appointment Proposal. You may select “For” “Against” or “Abstain” with respect to each of the Quorum Increase Proposal and the Equity Incentive Plan Proposal.

Annual Meeting?” below.

How does the Board

of Directors recommend that I vote?

Our Board

of Directors recommends that you vote your

Shares:shares as follows: | • | | “FOR” the

| | | | | |

| | Board Recommendation |

| Proposal No. 1: | The election of each of its nomineesLaurie Holcomb, Michael W. Lau, Heather Molloy, Jeffery Sears, Al Foreman and Mark Castaneda to our Board of Directors, each to serve as a director until the Board;2025 Annual Meeting of Stockholders and until a successor is duly elected and qualified. | FOR |

| Proposal No. 2: | The ratification of the appointment of Macias Gini & O’Connell LLP as the Company's independent registered public accounting firm for the year ending December 31, 2024. | FOR |

| • | | “FOR” the Equity Incentive Plan Proposal;

|

| • | | “FOR” the Quorum Increase Proposal; and

|

| • | | “FOR” the Auditor Appointment Proposal.

|

What is

How many votes do I have?

There were 287,617,407 shares of common stock issued and outstanding as of the

Quorum Requirement for the Meeting?The quorum for the transactionclose of business aton the Meeting is two persons who are, or who represent by proxy, Shareholders who, in the aggregate, hold at least 25%Record Date. Each share of our common stock that you owned as of the issued shares entitledRecord Date entitles you to be voted at the meeting.

Abstentions, broker “non-votes” (as described below), and withhold votes are counted as present, and therefore are included for the purposes of determining whether a quorum is present.

What vote is required to approve each item?

| | |

Proposal

| | Required Vote

|

Director Election Proposal | | Majority of the votes cast for each nominee |

| |

Equity Incentive Plan Proposal | | Majority of the votes cast on the proposal, excluding any votes cast by shareholders that would receive, or would be eligible to receive, a material benefit resulting from the adoption of the Plan. (as defined below) |

| |

Quorum Increase Proposal | | Two-thirds of the votes cast on the proposal |

| |

Auditor Appointment Proposal | | Majority of the votes cast on the proposal |

The Board has adopted a “majority voting” policy (the “Majority Voting Policy”). Pursuant to the Majority Voting Policy, the proxy card or voting instruction form for the vote at the Meeting will enable each Shareholder to vote “FOR” or “WITHHOLD” with respect to each nominee for director under the Director Election Proposal.

In an uncontested election of directors, as is the case with the election of directors at the Meeting, any nominee for election as a director who does not receive a greater number of votes “for” his or her election than votes “withheld” from such election (a “Majority Withhold Vote”) shall tender his or her resignation, as a director of the Company, to the Chair of the Board immediately following the meeting at which the director was elected, which resignation will become effective upon acceptance by the Board. Following each uncontested election of directors at which a Majority Withhold Vote occurs, the Company shall forthwith issue a news release disclosing the detailed voting results for the election of each director, and shall forthwith provide a copy of the news release to the Neo Exchange Inc. (the “Neo Exchange”) if there is a Majority Withhold Vote.

The Nomination and Corporate Governance Committee (the “NGC”) shall promptly consider any resignation offer from a director who has received a Majority Withhold Vote and recommend to the Board the action to be taken with respect to such tendered resignation. Such recommendation of the NGC may be to accept or reject the resignation on such basis as the NGC determines appropriate, provided that, in the absence of exceptional circumstances that would support rejection of the resignation, the NGC shall recommend acceptance of the resignation.

In considering a tendered resignation, and whether exceptional circumstances exist, the NGC will consider all factors deemed relevant to the best interests of the Company, including those set forth in the Majority Voting Policy.

Any individual who tenders his or her resignation pursuant to this policy and who is a member of the NGC shall not participate in any meeting of the NGC held to consider the resignation.

The Board shall consider and determine whether to accept or reject the NGC’s recommendation within 90 days following the applicable election of directors. In considering the NGC’s recommendation, the Board will consider the factors considered by the NGC and such additional information and factors that the Board considers to be relevant. Any individual who tenders his or her resignation pursuant to this policy shall not participate in any meeting of the Board held to consider the resignation. The Board shall accept the resignation except in situations where exceptional circumstances would warrant the applicable director continuing to serve on the Board. Following the Board’s decision, the Board shall promptly disclose, via news release, its decision whether to accept the director’s resignation offer and shall provide a copy of such news release to the Neo Exchange. If the Board rejects the resignation offer, the news release shall fully state the reasons for the rejection. If the resignation offer is accepted, the Board may, in accordance with the provisions of applicable law and the nomination rights, if any, of Shareholders, (i) leave the resultant vacancy in the Board unfilled until the next annual meeting of Shareholders of the Company, (ii) appoint a new director to fill the vacancy created by such resignation, (iii) reduce the size of the Board, or (iv) call a special meeting of Shareholders at which there will be presented a new candidate to fill the vacant position(s). The complete Majority Voting Policy is available on TPCO’s website at: https://ir.theparent.co/governance/governance-documents/default.aspx.

What are broker “non-votes”?

A “broker non-vote” occurs when a broker who holds its customer’s Shares in the name of a brokerage submits proxies for such Shares but indicates that it does not have authority toone vote on a particular matter. Generally, this occurs when brokers have not received any voting instructions from their customers. Without specific instructions, Canadian brokers are prohibited from voting their customers’ Shares.

Without specific instructions, U.S. brokers, as the holders of record, are permitted to vote their customers’ Shares on “routine” matters only, but not on other matters. The only proposal that constitutes a “routine”each matter on which U.S. brokers will have discretion to vote is the Auditor Appointment Proposal.

What effect on the outcome of the voting on the proposals will and broker “non-votes,” abstentions and “withhold votes” have?

Broker “non-votes” and abstentions will not be counted as votes cast and, therefore, will have no effect on the outcome of the voting on any of the proposals. If a shareholder selects “Withhold” with respect to the election of a nominee, their vote will not be counted as a vote cast for the purposes of electing such nominee but will be considered in the application of the Majority Vote Policy. A “Withhold” vote will have no effect on the votes cast with respect to the Auditor Appointment Proposal.

What happens if additional items are presented at the Meeting?

As of the date of this proxy statement, management of the Company knows of no such amendments, variations or other matters to come before theAnnual Meeting. However, if other matters properly come before the Meeting, the persons named as proxy holders, Troy Datcher and Mike Batesole, or either of them, or such other person as you appoint, will have discretion to vote the proxies held by them on those matters in accordance with their best judgment.

Where can I find theCumulative voting results?

We expect to announce preliminary voting results at the Meeting and to publish final results in a current report on Form 8-K that we will file with the SEC and in a press release that we will disseminate and file in Canada on SEDAR promptly following the Meeting. Both the Form 8-K and press release will also be available on the “SEC Filings” tab in the “Financials” section of our website at www.theparent.co.

How You Can Vote

What Shares can I vote?

You are entitled to vote all Shares owned by you on the Record Date, including (i) shares held directly in your name as the registered Shareholder and (ii) shares held for you as the beneficial owner through a bank, broker or other nominee. On the Record Date, there were 1,204 registered Shareholders holding 46,336,178 outstanding Shares, and there were 100,759,427 total Shares were issued and outstanding.

directors is not permitted.

What is the difference between holding

Sharesshares as a

registered Shareholder and"stockholder of record" as compared to as a

Non-registered Shareholder?"beneficial owner"?

Most of our

Shareholdersstockholders hold their

Sharesshares as a beneficial owner through a

broker, bank,

brokertrust or other nominee rather than

having the Shares registered directly in their own name.

SummarizedAs summarized below,

there are some distinctions between

Sharesshares held of record and those owned

beneficially by Non-registered Shareholders.Registered Shareholder

beneficially.

•Stockholder of Record:If your Sharesshares are registered directly in your name with our transfer agent, Odyssey Trust Company, you are considered, with respect to those shares, the registered Shareholderstockholder of record, and proxy materials are being sent directly to you by the Shares.Company.

•Beneficial Owner: If your shares are held in a stock brokerage account or by a bank, you are considered the beneficial owner of shares held in street name, and proxy materials are being forwarded to you by your bank or broker, which is considered the stockholder of record of these shares. As the registered Shareholder,beneficial owner, you have the right to grantdirect your bank or broker how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you bring with you a legal proxy from the stockholder of record. Your bank or broker has provided a voting instruction card to provide you directions for how to vote your Sharesshares.

If you do not wish to

representatives from the Company or to anothervote in person or

toyou will not be attending the Annual Meeting, you may vote

your shares electronically at the Meeting. You have received aby proxy

card to use in voting your Shares viaover the Internet, by telephone or by

mail.Beneficial or Non-Registered Shareholder

Ifmail (if you areproperly request a Non-registered Shareholder, your Shares are held through an Intermediary (e.g., bank, broker or other nominee), in which case it is likely that they your Shares are registeredpaper copy of these proxy materials) by following the instructions in the nameNotice of Internet Availability of Proxy Materials or on the Intermediary andvoting instruction card provided to you are the beneficial owner of Shares held in “street name”.

As the beneficial owner of Shares held forby your account, you have the right to direct the registered holder to vote your Shares as you instruct, and you also are invited to attend the Meeting and vote your Shares at the Meeting. Yourbroker, bank, broker, plan trustee, or other nominee has provided a voting instruction form for you to use in directing how your Shares are to be voted.

Ifnominee. See “How can I am a registered Shareholder, may I appoint a person to represent me at the Meeting other than the persons designated in the proxy card?

Yes. The persons named in the enclosed proxy card are directors or officers of TPCO designated by management of TPCO. A registered Shareholder has the right to appoint as proxyholder a person or company (who need not be a Shareholder) other than the persons already named in the enclosed proxy card to attend and act on such registered Shareholder’s behalf at the Meeting. If you wish to appoint as your proxy a person other than the individuals named on the proxy card to attend the Meeting and vote for you, you may do so by striking out the names on the proxy card and inserting the name of your proxy in the blank space provided in the proxy card, or you may complete another proper proxy card. In addition, you must provide your appointed proxy with your 16-digit control number so your proxy can vote at the meeting. Your appointed proxy need not be a shareholder of the Company. If you appoint a non-management proxyholder, please make them aware and ensure they will attend the meeting for the vote to count.

my shares ?” below. How can I vote my shares?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares

in personrepresented by valid proxies that we receive through this solicitation, and

participate at the Meeting?The Meetingthat are not revoked, will be conductedvoted in an exclusively virtual format via live Internet webcast available at www.virtualshareholdermeeting.com/GRAMF2022. You will be able to access the Meeting using an Internet connected device, such as a laptop, computer, tablet or mobile phone, and the meeting platform will be supported across browsers and devices that are running the most updated version of the applicable software plugins. You will needaccordance with your 16-digit control number (locatedinstructions on the proxy card voting instruction form or Notice ofas instructed via the Internet Availability)or telephone. You may specify whether your shares should be voted FOR, AGAINST or ABSTAIN with respect to enter the virtual Meeting as a Shareholder.

Shareholders aseach nominee for director and with respect to each of the Record Date can access and vote at the Meeting during the live webcast as follows:

| 1. | Log into www.virtualshareholdermeeting.com/GRAMF2022 at least 15 minutes before the Meeting starts. You should allow ample time to check into the virtual Meeting and to complete the related procedures.

|

| 2. | Enter your 16-digit control number into the Shareholder Login section (your control number is located on your proxy card,other proposals. If you properly submit a proxy without giving specific voting instruction form or Notice of Internet Availability) and click on “Enter Here.”

|

| 3. | Follow the instructions, to access the Meeting and vote when prompted.

|

Even if you currently plan to participate in the virtual Meeting, you should consider voting your shares will be voted in accordance with our Board of Directors’ recommendations as noted below. Voting by proxy in advance so thatwill not affect your vote will be counted in the event that you later decide notright to attend or are unable to access, the virtual Meeting. annual meeting.

If

you access and vote on any matter at the Meeting during the live webcast, then you will revoke any previously submitted proxy.Those accessing the virtual Meeting must remain connected to the Internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure Internet connectivity for the duration of the Meeting.

Guests will not be able to access the Meeting. You must have a 16-digit control number to access the Meeting.

Shareholders or their proxyholders with questions regarding the virtual Meeting portal or requiring assistance accessing the meeting website may call the technical support line at 1-800-586-1548 (toll-free) or 303-562-9288 (toll) or visit the website www.virtualshareholdermeeting.com for additional information.

How can I vote my shares without attending the Meeting?

To vote your shares without attending the meeting, please followare registered directly in your name through our stock transfer agent, Odyssey Trust Company, or you have stock certificates registered in your name, you may vote:

•By Internet or by telephone. Follow the instructions for Internet or telephone voting onincluded in the Notice of Internet Availability.Availability of Proxy Materials or, if you received printed materials, in the proxy card to vote over the Internet or by telephone.

•By mail. If you request printed copies of thereceived a proxy materialscard by mail, you may alsocan vote by mail by completing, signing, and submitting your proxy carddating and returning it by mail, if you are the registered Shareholder, or by signing the voting instruction form provided by your bank or broker and returning it by mail, if you are Non-registered Shareholder but not the registered Shareholder. This way your shares will be represented whether or not you are able to attend the meeting. As a Shareholder, you may vote as follows: | | |

Internet: | | Go to www.proxyvote.com. Enter the 16-digit control number printed on the Notice of Internet Availability, voting instruction form or proxy card and follow the instructions on screen. |

| |

Telephone: | | Call 1-800-474-7493 and follow the instructions. You will need to enter your 16-digit control number. Follow the interactive voice recording instructions to submit your vote. |

| |

Mail: | | Enter voting instructions, sign the proxy card or voting instruction form and return it in the prepaid envelope provided to:

Vote Processing, c/o Broadridge

51 Mercedes Way

Edgewood, NY 11717

|

Why a virtual Meeting?

We are excited to embrace virtual meeting technology, which we believe provides expanded access, improved communications and cost and time savings for our Shareholders and the Company. A virtual meeting enables increased Shareholder attendance and participation from locations around the world. We believe the cost and time savings afforded by a virtual meeting encourages more Shareholders to attend the Meeting. In addition, given the potential uncertainties in connection with the current COVID-19 pandemic, including risks related to travel and attending large gatherings, we believe that a virtual-only meeting is the most appropriate format for our Shareholders and other Meeting attendees.

What are the procedures with respect to submitting questions or comments for the Meeting?

We expect to hold, to the extent feasible and practical, a live question and answer session in connection with the Meeting. Registered Shareholders, duly appointed proxyholders and non-registered Shareholders will be able to submit questions for the question and answer session. Questions can be submitted only during the Meeting in writing through the live webcast at www.virtualshareholdermeeting.com/GRAMF2022 after logging-in and typing your question into the “Ask a Question” field, and clicking “Submit”.

We intend to answer properly submitted questions that are pertinent to the Company and Meeting matters, as time permits. Questions sent will be moderated before being sent to the Chair of the Meeting. The Company reserves the right to edit profanity or other inappropriate language, or to exclude questions that are not pertinent to Meeting matters or that are otherwise inappropriate.

How will my Shares be voted by my proxy if I am a registered shareholder?

If you appoint the members of Company management listed on the proxy card as your proxy, they will vote your Shares in accordance with your instructions. However, ifinstructed on the card. If you sign yourthe proxy card but do not give instructions,specify how you want your shares voted, they will vote your Sharesbe voted in accordance with our Board of Directors’ recommendations as noted below.

•By attending the Board’s recommendation: | • | | “FOR” the election of each of its nominees to the Board;

|

| • | | “FOR” the Equity Incentive Plan Proposal;

|

| • | | “FOR” the Quorum Increase Proposal; and

|

| • | | “FOR” the Auditor Appointment Proposal.

|

Ifvirtual meeting. You can visit www.virtualshareholdermeeting.com/GRAM2024, where you appoint someone other thanmay vote and submit questions during the members of Company management listedmeeting. Please have your control number located on theyour proxy card asor Notice in hand when you visit the website.

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on June 13, 2024.

If your

proxy, they will also voteshares are held in

accordance with your instructions or, if no instructions are given, as they in their discretion choose.Further details about the proposals are set out in this proxy statement. If any matters other than those referred to“street name” (held in the Noticename of Meeting properly come beforea bank, broker or other holder of record), you will receive instructions from the Meeting,holder of record. You must follow the individuals named in the accompanying proxy card will vote the proxies held by them in accordance with their best judgment. Asinstructions of the dateholder of this proxy statement, management is not aware of any business other than the items referredrecord in order for your shares to in the Notice of Meeting thatbe voted. Telephone and Internet voting also will be considered at the Meeting.

How do I revoke my proxy if I am a registered Shareholder?

If you wantoffered to revoke your proxy after you have delivered it, you can do so at any time before the proxy cut-off. You may do this by an instrument in writing that is sent to the registered office of the Company at any time up tostockholders owning shares through certain banks and including the last business day before the day set for the holding of the Meeting at which the proxy is to be used, or any adjournment thereof, or in any other manner permitted by law. You may also revoke your proxy by making a request in writing to the Chair of the Meeting by email to investor@theparent.co during the Meeting or any adjournment or postponement thereof before any vote in respect of which the proxy has been given or taken. The written request can be from you or your authorized attorney.

If you revoke your proxy and do not replace it with another that is deposited with the Company before the deadline, you can still vote your Shares, but to do so you must attend the Meeting.

If I am a Non-registered Shareholder, how will my Intermediary vote my Shares and how can I change my vote?

The information set forth in this section is of significant importance to Non-registered Shareholders.brokers. If your Sharesshares are not registered in your own name they will be held in the name of an Intermediary, usually a bank, trust company, securities dealer or other financial institution and as such, your Intermediary will be the entity legally entitledyou plan to vote your Shares and must seek your instructions as to how to vote your Shares.

Intermediaries are required to seek voting instructions from Non-registered Shareholdersshares in advance of Shareholder meetings. Every Intermediary has its own mailing procedures and provides its own return voting instructions, which should be carefully followed by Non-registered Shareholders to ensure that their Shares are votedperson at the Meeting. Often, the form of voting instruction form supplied to a Non-registered Shareholder by its Intermediary is identical to the form of proxy provided by the Company to the Intermediaries. However, its purpose is limited to instructing the Intermediary on how to vote on behalf of the Non-registered Shareholder. The majority of Intermediaries now delegate responsibility for obtaining instructions on how to vote from clients to Broadridge Investor Communications Corporation (“Broadridge”). Broadridge typically mails the voting instruction form to the Non-registered Shareholders and asks the Non-registered Shareholders to return the voting instruction form to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Shares to be represented at the Meeting. A Non-registered Shareholder receiving a voting instruction form from Broadridge cannot use that voting instruction form to vote Shares directly at the Meeting. The voting instruction form must be returned to Broadridge or the Intermediary well in advance of the Meeting to have the Shares voted. TPCO (though Broadridge) is sending proxy materials and a voting instruction form directly to non-objecting beneficial owners and objecting beneficial owners.

Ifannual meeting, you are a beneficial owner of shares registered in the name of an Intermediary, you may generally change your vote by (1) submitting new voting instructions to your Intermediary or (2) by attending the Meeting and voting in person. However, please consultshould contact your broker or other Intermediary for any specific rulesagent to obtain a legal proxy or broker’s proxy card and bring it may have regarding your ability to change your voting instructions.

When is the deadline to vote?

If you hold Shares as the Shareholder of record, your vote by proxy must be received before 11:59 p.m. (New York City time) on June 21, 2022 or, if the Meeting is adjourned or postponed, at least 48 hours (excluding Saturdays, Sundays and statutory holidays in the Province of British Columbia) before the beginning of any adjourned or postponed meeting.

If you are a Non-registered Shareholder (i.e., you are a beneficial owner), please follow the voting instructions provided by your bank, broker or other nominee.

Who will count the votes at the Meeting?

A representative of Broadridge will act as scrutineer at the Meeting and will count the votes.

Shareholder Proposals and Director Nominations

What is the deadline to submit Shareholder proposals to be included in the proxy materials for next year’s annual general meeting?

The Company is subject to the rules of both the SEC under the Exchange Act, and provisions of the Business Corporations Act (British Columbia) (“BCBCA”) with respect to Shareholder proposals. As clearly indicated under the BCBCA and SEC rules under the Exchange Act, simply submitting a Shareholder proposal does not guarantee its inclusion in the proxy materials.

Shareholder proposals submitted pursuant to SEC rules under the Exchange Act for inclusion in the Company’s proxy materials for next year’s annual general meeting must be received by our Corporate Secretary no later than the close of business (Pacific Time) on January 6, 2023, and must be submitted to our Corporate Secretary at TPCO Holding Corp., 1550 Leigh Avenue, San Jose, CA 95125. Such proposals must also comply with all applicable provisions of Rule 14a-8 under the Exchange Act. In the event that we hold our 2023 annual general meeting of Shareholders more than 30 days before or after the one-year anniversary date of the Meeting, we will disclose the new deadline by which Shareholders’ proposals must be received by any means reasonably calculated to inform Shareholders.

The BCBCA also sets out the requirements for a valid proposal and provides for the rights and obligations of the Company and the submitter upon a valid proposal being made. Proposals submitted under the applicable provisions of the BCBCA that a Shareholder intends to present at next year’s annual general meeting and wishes to be considered for inclusion in the Company’s proxy statement and form of proxy relating to next year’s annual meeting must be received at least three (3) months before the anniversary of the Company’s last annual general meeting (March 22, 2023). Such proposals must also comply with all applicable provisions of the BCBCA and the regulations thereunder.

Proposals that are not timely submitted or are submitted to the incorrect address or other than to the attention of our Corporate Secretary may, at our discretion, be excluded from our proxy materials.

See below under the heading “How may I nominate director candidates or present other business for consideration at a meeting?” for a description of the procedures through which Shareholders may nominate director candidates for consideration.

How may I nominate director candidates for consideration at a meeting?

Shareholders who wish to submit director nominees for consideration at next year’s annual meeting must give written notice of their intention to do so, in accordance with the deadlines described below, to our Corporate Secretary at the address set forth below under the heading “How do I obtain additional copies of this proxy statement or voting materials?” Any such notice also must include the information required by our Articles (“Articles”) (which may be obtained as provided below under the heading “How may I obtain financial and other information about TPCO Holding Corp.?”) and must be updated and supplemented as provided in the articles.

Written notice of director nominees must be received, in the case of an annual meeting, not later than 5:00 p.m. (Vancouver time) on the thirtieth (30th) day before the date of the annual meeting of Shareholders; provided, however, that if the annual meeting of Shareholders isin order to be held on a date that is less than fifty (50) days after the date on which the initial public announcement of the date of the annual meeting of Shareholders was made, notice by the nominating Shareholder may be made not later than the close of business on the fifteenth (15th) day following such public announcement; and further provided, that if vote.

notice-and-access

is used for delivery of proxy related materials in respect of such meeting, and the annual meeting of Shareholders is to be held on a date that is less than fifty (50) days after the date on which the initial public announcement of the date of the annual meeting of Shareholders was made, the notice must be received not later than the close of business on the fortieth (40th) day before the date of the applicable meeting.

How may I recommend candidates to serve as directors?

It is the policy of the NGC to consider properly submitted recommendations for candidates to the Board from shareholders, subject to contractual obligations the Company may have with respect to the nomination of directors. In this regard, please see “Proposal 1—Director Election Proposal—Nomination Rights Agreement” for a discussion of the nomination rights provided to certain Shareholders.

Shareholder recommendations for candidates to the Board must be directed in writing to TPCO Holding Corp., 1550 Leigh Avenue, San Jose, California 95125, Attention: Corporate Secretary. Such recommendations must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and TPCO within the last three years and evidence of the nominating person’s ownership of TPCO stock, if any. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for Board membership, including issues of character, integrity, judgment, diversity, age, independence, skills, education, expertise, business acumen, business experience, length of service, understanding of TPCO’s business, other commitments and the like, as well as any personal references and an indication of the candidate’s willingness to serve.

Potential nominees recommended by a Shareholder in accordance with these procedures will be considered and evaluated in the same manner as other potential nominees.

For information regarding the factors considered by the NGC in nominating directors for election or appointment, please see “Corporate Governance—Nomination and Governance Committee— Policies with Respect to Director Nominees”.

Obtaining Additional Information

How may I obtain financial and other information about TPCO Holding Corp.?

Our consolidated financial statements are included in our Annual Report on Form 10-K. We filed our Annual Report on Form 10-K with the SEC on March 31, 2022. We will furnish a copy of our Annual Report on Form 10-K (excluding exhibits, except those that are specifically requested) without charge to any Shareholder who so requests by writing to our Corporate Secretary at the address below under the heading in “How do I obtain additional copies of this proxy statement or voting materials?” The Annual Report on Form 10-K is also available free of charge on the “SEC Filings” tab in the “Financials” section of our website at www.theparent.co, on the SEC’s website at www.sec.gov, and on SEDAR at www.sedar.com.

What if I have questions for the Company’s transfer agent?

If you are a

ShareholderStockholder of record and have questions concerning share certificates, ownership transfer or other matters relating to your share account, please contact our transfer agent at the following address:

Odyssey Trust Company

350 – 300 5th Avenue SW

Calgary, Alberta T2P 3C4

2155 Woodlane Drive

Suite 100

Woodbury, MN 55125

Phone: 1-651-583-6391

Can I change my vote or revoke my proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

•if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above;

•by re-voting by Internet or by telephone as instructed above;

•by notifying our Corporate Secretary in writing before the Annual Meeting that you have revoked your proxy; or

•by attending the Annual Meeting and voting at the meeting. Attending the Annual Meeting will not in and of itself revoke a previously submitted proxy. You must specifically request at the Annual Meeting that it be revoked.

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What if I receive more than one Notice of Internet Availability of Proxy Materials or proxy card?

You may receive more than one Notice of Internet Availability of Proxy Materials or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How can I vote my shares?” for each account to ensure that all of your shares are voted.

Will my shares be voted if I do not vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How can I

obtain additional copiesvote my shares?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 2 of this proxy

statementstatement) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or

other nominee. This ensures your shares will be voted at the annual meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting

materials?authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

How many shares must be present or represented to conduct business at the Annual Meeting?

A "quorum" is necessary to conduct business at the Annual Meeting. The presence, in person or by proxy, of the holders of a majority of the voting power of the stock outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

What are the voting requirements to approve the proposals discussed in this Proxy Statement?

•Proposal No. 1: Election of directors. The nominees for directors, in an uncontested election, will be elected if the number of votes cast “for” the nominee’s election exceeds the number of votes cast “against” the nominee’s election. If the Secretary determines that the number of nominees for director exceeds the number of directors to be elected, directors will be elected by a plurality of the votes of the shares represented in person or by proxy at the Annual Meeting. A plurality means that the nominees receiving the most votes for election to a director position are elected as directors up to the maximum number of directors to be chosen at the meeting. For each nominee, you may vote either FOR, AGAINST or ABSTAIN. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. If a nominee for director who is not an incumbent director does not receive a majority of the votes cast, the nominee will not be elected. The Nomination and Governance Committee has established procedures under which a director standing for reelection in an uncontested election must tender a resignation conditioned on the incumbent director’s failure to receive a majority of the votes cast. If an incumbent director who is standing for reelection does not receive a majority of the votes cast, the Nomination and Governance Committee will make a recommendation to the Board of Directors on whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors will act on the committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the

election results. The director who fails to receive a majority vote will not participate in the committee’s recommendation or the Board of Directors’ decision.

•Proposal No. 2: Ratification of the appointment of Macias Gini & O’Connell LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. The approval of this Proposal No. 2 requires the affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on Proposal No. 2. Abstentions will have the effect of a vote against this proposal. The failure of a holder of record to vote will also have the effect of a vote against this proposal. Brokerage firms have the authority to vote customers’ unvoted shares held by firms in street name on this proposal. If a broker does not exercise this authority, it will have the effect of a vote against the proposal. Accordingly, it is critical that all holders vote on Proposal No. 2. We are not required to obtain the approval of our stockholders to appoint our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of Macias Gini & O’Connell LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, our audit committee of our Board of Directors will reconsider its selection.

Who will bear the cost of soliciting votes for the Annual Meeting?

We will pay the entire cost of preparing, assembling, printing, mailing and distributing the Notice of Internet Availability of Proxy Materials and these proxy materials, as well as for soliciting votes. Our directors, officers and employees may solicit proxies or votes in person, by telephone or by electronic communication. We will not pay our directors, officers or employees any additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward the applicable proxy materials to their principals and to obtain authority to execute proxies and will reimburse them for certain costs in connection with such activities.

Who will count the votes?

Votes will be counted by the inspector of election appointed for the Annual Meeting.

Where can I find the voting results of the Annual Meeting?